Twitter Takeover

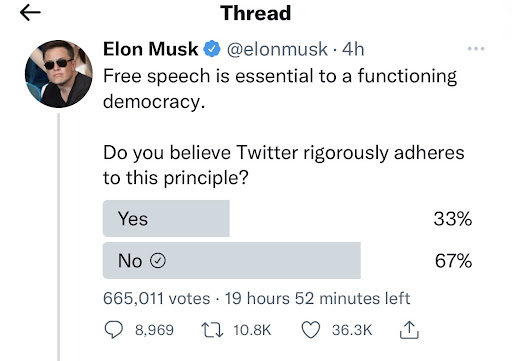

An example of one of Elon Musk’s famous twitter polls.

May 3, 2022

Elon Musk becomes the largest shareholder of Twitter stock with 9.2% on March, 14. He was shortly after surpassed by Vanguard Group purchasing a 10.3% stake in the company.

Musk’s shares are worth about $2.89 billion after spending $2.64 billion. His purchase resulted in the stock price to skyrocket by 27%.

Musk was among Twitter’s most influential users even before purchasing the shares. He uses his platform to preach freedom of speech and expression. Musk is at about 80.5 million followers currently and asked them if they feel like Twitter “Rigorously Adheres” to free speech. More than 70% of replies said no.

Musk was talking about the constitutional right under the First Amendment to free speech. As a company, Twitter decides on what is able to be said on the platform and it requires users to agree to terms of service before using the app.

“Specifically, Musk could seek to influence the openness of the platform and how it controls content or push to invest in the subscription model more aggressively,” said Ali Mogharabi, a senior equity analyst for Morningstar.

On March 26, Musk talked about his consideration of creating a new social platform. This came nearly two weeks after his purchase of the stake in the company. It is said that his stake in the social media giant could lead to a successful action for his long-term strategy.

Last year Twitter implanted a new subscription for $3 a month called Twitter Blue. This allows users to undo tweets, read ad-free articles and have access to many more features.

Musk has not always been a good influence on the platform. In 2018 one Tweet left him in a bad spot. Musk got into legal trouble with the Security and Exchange Commission (SEC) when he told his audience that he was taking Tesla stock private. He was sued for saying “false and misleading” information to the company’s investors.

The settlement ended with Musk and Tesla paying $20 million and allowing the SEC to have some supervision on his tweets.