Temperature rising, and so are prices

November 9, 2022

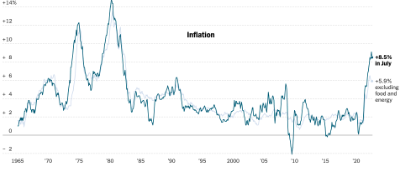

Inflation is not only an issue going on in the U.S. but in the world. It can be an adequate necessity but can also be a negative impact on the economy and people in the community. According to NBC News, over the summer of 2022 inflation rates have gone from a normal three percent to an astounding nine point one percent.

“[I’ve] Significantly have noticed our grocery bill has increased by like hundreds of dollars,” said Jonathan Hakim.

Not only is inflation taking place in grocery stores, but it costs more to fill your gas tank to get there.

“Instead of maybe putting extra money into investing, I now have to put that extra money into gas or goods,” says personal finance teacher Brian Stormes.

Those with a fixed income are unable to afford rising prices when their pay is not. A fixed income is a steady income usually with no fluctuations or changes. In addition, expendable income disappears impacting organizations looking for donations.

“People are donating less and sponsoring [fewer] events because they don’t have the extra money they used to because everything costs more. Retired people and people on disability… that’s who it hurts the most,” said Hakim.

According to NBC News, the Federal Reserve(FED) has been trying slow demand during the summer in the desire to lower the high inflation rates.

“It will eventually level out, so what the FED tries to control is by raising interest rates. So some people are saying if they raise them too high we can go into deflation which means prices will come down, if they come down too far that can lead to a recession,” says Stormes.

Eventually, people hope for it to balance out, but before that, some of the more significant issues need to be resolved.

“The number one problem is supply chain issues causing prices to go up, the second is supply and demand, and the third is there is too much money circulating in the economy,” says Hakim.

With the 8.5% increase over the summer, people are looking forward to gas and prices going down.

“I think in the long term inflation is going to come down, but I don’t expect anything soon,” says Hakim.

Photo by Bureau of Labor Statistics.