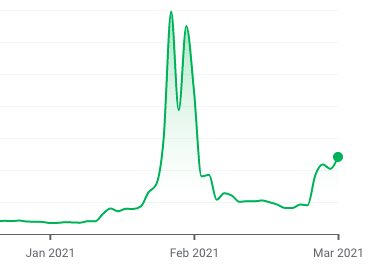

GameStop’s short squeeze

March 18, 2021

At the height of the Jan. 27 squeeze, the world was shocked by the GameStop ($GME) stock short squeeze. A short squeeze is when lots of people buy a certain stock and it rapidly increases in value. When many people of the social media platform Reddit gathered on the forum, or subreddit, r/wallstreetbets, they found a loophole to take money away from those who bet against GameStop stocks.

Many big companies and rich individuals, known as hedge funds, will bet on which stocks they believe will perform better. “Redditors,” as they call themselves saw that hedge funds were shorting GameStop stocks, a company that is very closely rooted to many of the Redditors’ childhoods. They saw that the rich were trying to increase their power and monopolize the stock market and decided to take action.

The hedge funds were the ones who bet against GameStop; however, the civilians on Reddit found a loophole to take money away from the rich. They figured out that if they started buying large amounts of GameStop stocks, those who bet against the stock growing would lose lots of money, increasing their own gains.

Robinhood, an electronic stockbroking platform, markets its program as the preferred investor platform for the average person found itself at the center of the $GME stock squeeze.

“So many people have Robinhood. More younger investors have used Robinhood more than ever,” said Ben Lucia, a business and math teacher at Central York High School. “Robinhood was marketed for people who don’t have a lot of money.”

However, this platform partnered with big companies and kept the average person from buying GameStop stocks. This meant that the price of the stock could not increase in value and could only decrease, which would benefit the rich and the wealthy.

“This is where it got messy. All of these trading platforms, online brokers, starting taking in more business than they could handle with the GameStop situation,” said Lucia.

These online brokers then froze the trading of GameStop stocks completely for a 24-hour period. The next day, they opened the selling of GameStop again; however, this would only further decrease the stocks’ value and give the hedge funds time to recover and minimize their losses. It took these e-brokers another two days to open the buying of GameStop again, but the damage was already done. The hedge funds lost approximately 20 billion dollars, according to Forbes. In addition, the freeze prevented everyday traders from increasing their gains even further.

“Social media is what brought the awareness,” said Lucia.

Lucia believes that GameStop’s short squeeze could have never happened had this taken place 20 to 30 years ago. Social media was truly the reason that this happened, and Reddit had a forum for people to learn about shorting and find a way to take down the hedge funds.

“It brought more awareness to the stock market to a lot [over nine million] of people in general. It [social media] also brought a lot of awareness to ‘shorting’ because a lot of people didn’t even know you could do that,” said Lucia.

The spike of GameStop’s stock was not a one-time thing. Although the first spike took the stocks’ price from $20.00 to $380.00, the company saw a second spike occur on March 1 reaching $134.00 per share.

From Google Finance.

![“She [Walker] was the biggest advocate for any student,” said Basile.](https://mundismillmedia.com/wp-content/uploads/2023/05/Colorful-Watercolor-Note-Paper-with-Brush-Stroke-A4-Document-336x475.png)